Texas Governor Signs Banking Development Bill Into Law

June 19, 2015

The Texas legislature seeks to reduce the number of “banking deserts” in the state by improving access to mainstream financial services, such as savings accounts and small business loans.

On June 19, 2015, Governor Greg Abbott of Texas signed into law HB 1626, which was introduced by the Young Texans Legislative Caucus Chair, Rep. Eric Johnson.

HB 1626 aims to reduce the number of “banking deserts” in Texas by establishing “banking or credit union development districts” that encourage mainstream financial institutions to establish branches where there is a demonstrated need for their services.

“Step one is to get the banks in these communities, and step two is to get people using the banks. But step three, once we’ve stabilized some of these individuals and families, is to grow the people who want to be entrepreneurs and become business owners in our community.”

— Rep. Eric Johnson

According to the Federal Deposit Insurance Corporation (FDIC), about 36 percent of Dallas-area households are deemed “unbanked” or “underbanked,” meaning they either have no bank account at all or rely mostly on check cashers and other non-bank providers for financial services. Furthermore, four in ten Texas households (or about 38 percent) fall into one of these categories, compared to about 27 percent of households nationwide.

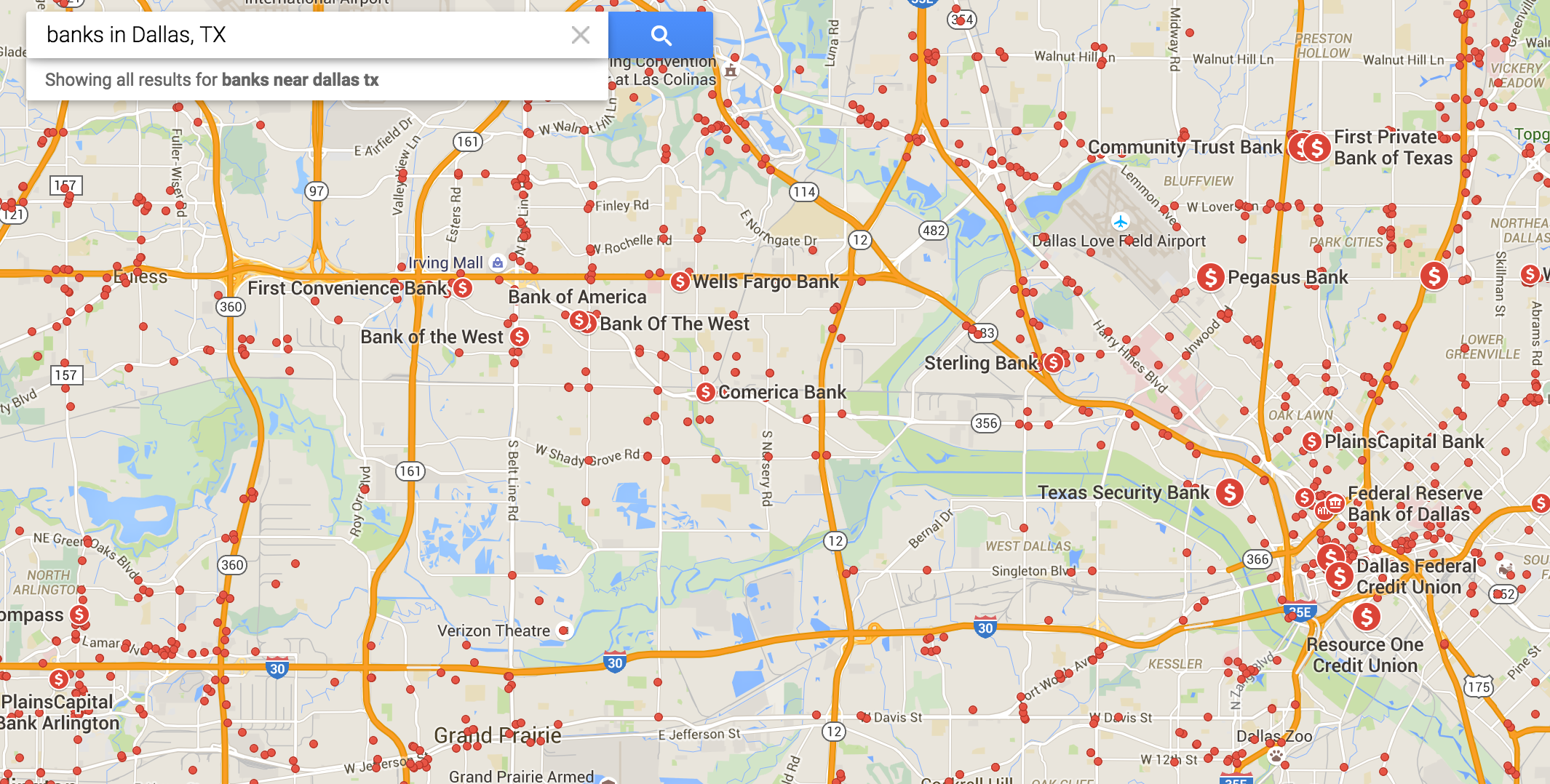

A map of the “banking desert” areas to the west of the Trinity River in Dallas, Texas.

HB 1626 allows county and municipal governments, in conjunction with a financial institution, to apply to the Finance Commission of Texas and the Texas Credit Union Commission to establish a “banking or credit union development district.” If approved, the city’s treasury will deposit funds into the district’s depository so that the bank or credit union could begin to offer its financial services to members of the community.

In exchange for opening branches in these districts, the financial institution will pay below-market rates on the city’s deposits, and will be eligible for tax breaks and other incentives.

HB 1626 will go into effect on September 1, 2015.

Join 1,800+ BIPARTISAN LEADERS NATIONWIDE

Be a part of a network of lawmakers committed to governing effectively, passing more representative public policy, and increasing public trust in democracy.